Navigating the Sole Trader Bounce Back Loan: What If I Can't Pay It Back?

Navigating the Sole Trader Bounce Back Loan: What If I Can't Pay It Back?

Blog Article

Revealing the Advantages and Application Refine of Financial Support With Recover Lending

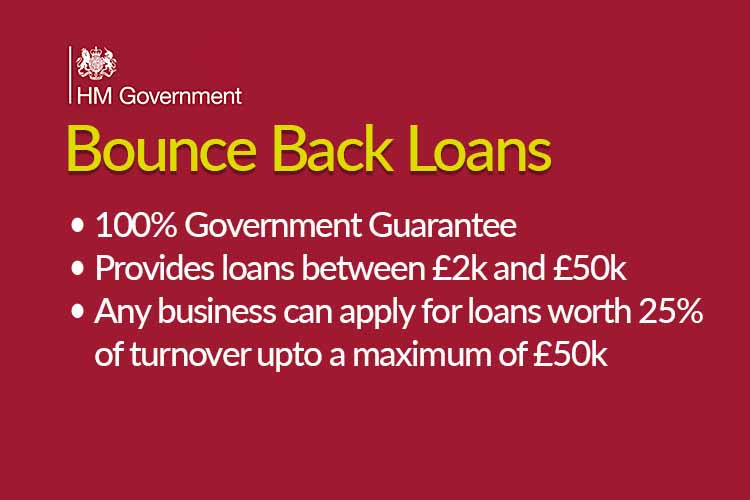

In today's challenging economic environment, comprehending the avenues offered for financial backing is vital for organizations making every effort to browse unsure times. The Bounce Back Car loan system has actually become an essential lifeline for lots of business, providing a structured application process and favorable terms. Nevertheless, the benefits and ins and outs of this assistance system often stay veiled to many. Dropping light on the eligibility requirements, benefits, application procedure, and repayment terms of the Recover Lending can be crucial in encouraging organizations to make enlightened decisions concerning their monetary well-being. Let's explore exactly how this plan can possibly strengthen your business and the actions included in using this necessary resource.

Eligibility Requirements for Recover Lending

Furthermore, to get approved for a Get better Financing, business has to not have actually currently received a funding with the Coronavirus Business Interruption Car Loan Plan (CBILS), the Coronavirus Large Company Disturbance Funding Plan (CLBILS), or the Financial institution of England's COVID Corporate Funding Center Plan. It is essential to supply accurate information and paperwork throughout the application process to demonstrate qualification and make certain a smooth authorization process (how to write off bounce back loan sole trader). By fulfilling these criteria, businesses can access the financial backing they require to navigate the obstacles posed by the pandemic

Advantages of Get Better Lending

Having actually satisfied the stringent eligibility criteria for a Recover Financing, organizations can now discover the various benefits that include this financial backing option. One vital benefit is the simpleness and rate of the application procedure. Compared to traditional finances, Get better Lendings involve minimal documents and can frequently be accepted quickly, providing services with rapid access to much-needed funds. Furthermore, these loans featured a government-backed guarantee, offering lending institutions self-confidence to provide support to a broader variety of businesses, consisting of those with limited credit rating background or security.

With a set interest rate of 2.5%, businesses can safeguard financing at a reduced cost compared to other kinds of funding. The first 12-month repayment vacation allows services to funnel their sources towards recovery and development prior to starting to settle the car loan.

Application Process Streamlined

Streamlining the application procedure for a Recover Funding has actually been a critical focus to improve availability for services seeking financial backing. The simplified application procedure includes loading out an online kind given by the participating lenders. To apply, organizations need to offer fundamental info such as their business information, the lending quantity called for, and confirmation that they satisfy the eligibility requirements. Unlike standard lending applications, the Get better Loan application requires minimal paperwork, decreasing the moment and effort needed to complete the process. Furthermore, the government-backed scheme has actually gotten rid of the demand for personal guarantees and substantial debt checks, making it less complicated for services to access the funds promptly. This structured technique not just accelerates the application procedure but additionally makes sure that businesses can receive the financial assistance they need promptly, helping them browse through difficult times with higher convenience.

Recognizing Car Loan Repayment Terms

The streamlined application procedure for the Bounce Back Finance has led the way for businesses to now understand the critical facet of finance settlement terms. Comprehending the settlement terms is essential for customers to effectively handle their financial commitments and stay clear of any type of prospective risks. The Bounce Back Loan provides beneficial payment terms, consisting of a settlement vacation for the very first twelve month, no fees, and a low set rate of interest of 2.5% per annum afterwards. Payment terms typically span approximately 6 years, giving companies with sufficient time to pay off the obtained amount without excessive economic strain.

It is necessary for debtors to familiarize themselves with the lending settlement schedule, including the monthly installment amounts and due dates, to guarantee timely payments and preserve an excellent economic standing. Failing to abide by the agreed-upon repayment terms could result in surcharges, penalties, and damage to the borrower's check my source credit scores ranking. Remaining educated and aggressive in handling funding payments is paramount for the long-lasting economic wellness of the organization.

Tips for Optimizing Bounce Back Financing Benefits

To totally utilize the benefits of the Get better Car loan, tactical financial preparation is vital for businesses intending to maximize their financial assistance. First of all, it is essential for services to evaluate their existing monetary situation precisely. By recognizing their cash money circulation needs and recognizing areas where the car loan can have one of the most significant impact, firms can make educated decisions on how to allot the funds successfully. Second of all, organizations should prioritize using the lending for activities that will directly contribute to earnings generation or price financial savings. Whether it's purchasing advertising and marketing projects to attract brand-new clients or updating essential tools to boost efficiency, focusing on efforts that will certainly generate concrete returns can assist make the most of the loan benefits. Furthermore, surveillance and handling costs post-loan dispensation is vital to guarantee that the funds are utilized carefully. By tracking investing, companies can make changes as needed to remain on track with their monetary goals and maximize the support given by the Recuperate Lending.

Verdict

Finally, the Recover Car loan gives financial backing to qualified organizations with streamlined application procedures and positive settlement terms. Understanding the qualification criteria, advantages, and payment terms is vital for making best use of the benefits of this finance. By following the described suggestions, companies can maximize the financial backing provided with the Get better Loan.

Furthermore, to certify for a Bounce Back Financing, the service must not have already obtained a financing via the Coronavirus Company Disruption Car Loan Plan (CBILS), the Coronavirus Large Organization Disruption Financing System (CLBILS), or the Bank of England's COVID Corporate Funding Facility Scheme. Contrasted to conventional lendings, Bounce Back Financings include minimal paperwork and can typically be accepted swiftly, giving companies with fast access to much-needed funds. To apply, companies need to provide fundamental information such as their business information, the loan quantity required, and confirmation that they fulfill the eligibility requirements. Unlike conventional loan applications, the Bounce Back Loan application requires marginal paperwork, minimizing the time and effort required to finish the procedure.The streamlined application procedure for the Bounce Back Lending has actually led the means for companies to currently understand the essential element of loan payment terms.

Report this page